At a Glance

A business line of credit gives you capital to meet a whole variety of business needs. Draw on your business line of credit to get more working capital, buy inventory, handle seasonal cash flow gaps, pay off other debts, or address almost any other business emergency or opportunity.

Next Loan Type:

Maximum Loan Amount

Maximum Loan Amount

$10,000 to over $1 million

Loan Term

Loan Term

6 months to 5 years

Interest Rates

Interest Rates

7 to 25%

Speed

Speed

As little as 2 days

Business Line of Credit Advantages & Disadvantages

✔ Lowest down payments

✔ Only pay interest on funds drawn

✔ Capital is available when needed

✔ Suitable for a wide range of business purposes

✔ Bad credit is acceptable

✔ Excellent way to build your credit score

☓ Might need to provide updated documents upon each draw

☓ May require collateral

☓ Higher rates for lower credit scores

How Do Business Lines of Credit Work?

Surprises happen—it’s a fact of life.

But how can you expect the unexpected when it comes to your business? A single accident could set you back a long way if you’re not prepared.

That’s why flexible business financing is so important.

And Fundera helps thousands of small business owners get that funding in the form of a business line of credit.

Let’s learn more about how a business line of credit can help you weather storms and take advantage of unforeseen opportunities.

Business Lines of Credit: A Flexible Financing Option

What exactly is a business line of credit?

Simply put, a business line of credit is pretty similar to a personal line of credit (like your credit card).

A bank or lender gives you access to a specific amount of financing, which you can draw from whenever you want or need.

However, you don’t make payments or incur any interest until you actually tap into those funds. You pay for what you use, in other words.

An Example of “Revolving” Business Credit

Business lines of credit can come secured—backed by collateral like inventory, accounts receivable, and so on—or unsecured, backed by your personal guarantee.

This sort of financing often gets referred to as “revolving” credit because you can tap into it again and again… And when you repay what you’ve spent, you can take out even more.

For instance, say you’re given access to a $60,000 small business line of credit.

Next, you decide to take out $40,000, keeping the other $20,000 in the pool of available funds.

Once you pay that $40,000 back (plus interest), you’ll have the whole $60,000 at your fingertips again—without having to apply for another loan.

The time and energy you save is one of the biggest benefits to a business line of credit.

Business Lines of Credit vs. Traditional Term Loans

So what sets a business line of credit apart from a traditional term loan?

To start with, business lines of credit usually come with lower interest rates and closing costs than traditional term loans of similar sizes.

But on the other hand, if you’re late with a payment or go over your credit limit, that interest rate could spike pretty high.

Also, traditional term loans have regular interest rates over the life of the loan, which is a major difference between term loans and business lines of credit.

If you’re comparing a business line of credit with a traditional term loan, keep in mind that lines of credit tend to work better for repeated cash flow issues while term loans often make more sense when it comes to specific purchases. But that doesn’t mean you can’t or shouldn’t use a business line of credit for business purchases, too.

Different Kinds of Business Lines of Credit

Though it’s not an industry standard, we split business lines of credit up into short-term andmedium-term.

Why?

Although business lines of credit don’t really have term lengths—you can withdraw and pay back those funds indefinitely, as long as your lender believes that you’re a responsible borrower—these labels help you compare short-term loans with short-term lines of credit and traditional term (or “medium-term”) loans with medium-term lines of credit.

The differences are mostly in their minimum qualifications, maximum fund amounts, and interest rates.

How a Business Line of Credit Can Help You

The bottom line?

The biggest advantage of a business line of credit is its renewability: you can draw out funds, pay them back, and draw again.

You can use a small business line of credit to help finance ongoing operating expenses, cover cash flow gaps, take advantage of unexpected opportunities, and provide a cushion to protect against emergencies.

Since lines of credit are so flexible, they can also be used for payroll, seasonal expenses, and unforeseen problems or investments, as well as larger purchases.

This flexibility is what makes a business line of credit such a valuable loan product for small business owners.

Business Line of Credit vs. Credit Card

Although business lines of credit and credit cards are both forms of “revolving” credit, there are a few important differences you should be aware of:

1. Credit cards usually have higher interest rates.

2. Credit cards charge additional fees for cash advances and, often, balance transfers.

3. Credit cards typically require payments on a monthly basis while business lines of credit usually don’t.

Suggested Resources

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

What Will a Business Line of Credit Cost You?

The basic cost of a business line of credit is pretty straightforward: you take, you pay.

Unlike with a traditional term loan, which is one big lump sum with regular repayments, with a business line of credit you’ll only pay interest on the cash you draw.

How a Business Line of Credit Can Help with Cash Flow

Let’s say it’s time to pay the bills, but you’re still waiting to receive payment from your own customers—making it a bit tough for you to pay what you owe.

And it’s not the first time this has happened, unfortunately.

You calculate that having a financial cushion of some amount—for our example, let’s say $25,000—would help prevent this problem in the future.

So you reach out to an online financial institution and apply to open a small business line of credit of up to $25,000.

Withdrawing Funds & Paying Them Back

Next time you need to pay your bills and you’re still waiting on that cash from your customers, you can draw out funds on the business line of credit to cover your debts.

You needed $5,000 to pay those bills, so you pull $5,000 out of your business line of credit.

And even though you have a $25,000 line of credit, you’ll only need to pay back the $5,000 you borrowed, plus any interest.

Plus, keep in mind that the interest only gets charged on the $5,000 you borrowed, not the full $25,000 you have access to.

So…

If your interest rate is 11%, you’ll have to pay back $5,550 (or $5,000 plus $550 in interest).

Once that’s paid off, you can continue making additional draws up to the $25,000 maximum, only paying interest on what you’re borrowing at any given time.

Suggested Resources

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

Lorem ipsum dolor sit amet, consectetuer read more…

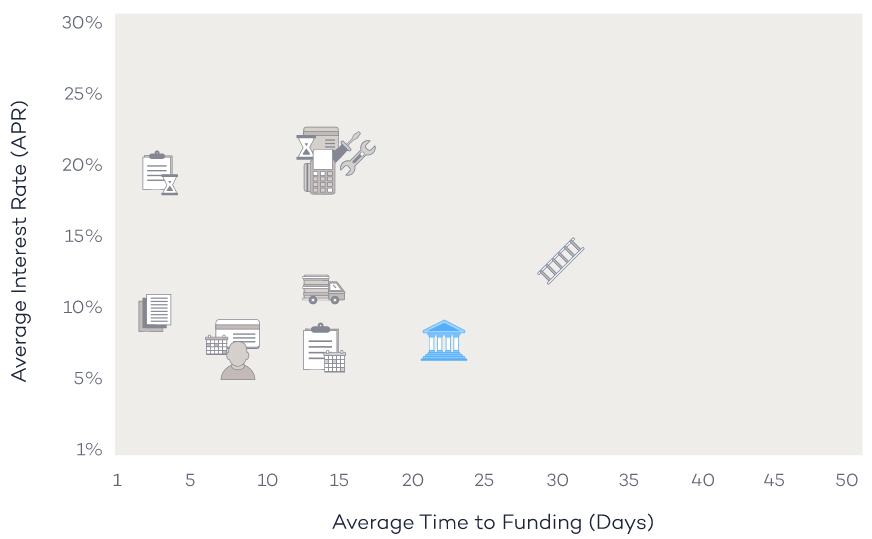

Interest Rate vs Time to Funding

Avg. Time to Funding

Avg. APR (%)

Business Line of Credit

SBA Loan

SBA Loan

Traditional-Term Business Loan

Traditional-Term Business Loan

Equipment Financing

Equipment Financing

Invoice Financing

Invoice Financing

Short-Term Business Loan

Short-Term Business Loan

Merchant Cash Advance

Merchant Cash Advance

Startup Loan

Startup Loan

Personal Loan for Business

Personal Loan for Business

As little as 2 days

As little as 30 days

As little as 2 days

As little as 2 days

As little as 1 day

As little as 2 day

8% and up of daily credit card sales

As little as 2 weeks

As little as 4 days

7 – 25%

6 – 13%

7 – 30%

8 to 30%

Approx. 3% + %/wk outstanding

Starting at 14%

1.14 – 1.48

7.9 – 19.9%

5.99 – 36% APR

Who Qualifies for Business Lines of Credit?

What sorts of businesses are eligible for this flexible financing?

Younger, less established businesses might be able to qualify for short-term lines of credit, while medium-term lines of credit are more for businesses with good credit and a solid financial history.

The maximum amount of funding available, introductory duration of the credit line, and repayment terms depend on your business’s revenues, credit rating, history, and other factors.